Becoming a millionaire is a lofty financial milestone that many dream of reaching

It holds an enduring fascination. The term “millionaire” is associated with opulence, success, and the realization of dreams. Yet, the odds of achieving this status can appear insurmountable, especially in a world where financial disparities are profound.

This article explores the improbable journey toward becoming a millionaire. We delve into the historical perspective, financial statistics, as well as the factors that influence millionaire status. It is a financial aspiration with profound significance, so we examine both the allure and the arduous path to millionaire status. You’ll also find some case studies, the role of saving and investing, challenges, and the psychology of wealth.

Historical Perspective

The notion of millionaires has undergone significant transformations throughout history, both in terms of the perception and the number of individuals who could lay claim to this status.

In historical perspective, some of the earliest examples of millionaires were monarchs, conquerors, and rulers who amassed wealth through the control of vast territories. Mansa Musa of the Mali Empire is well known for his wealth and generosity. His lavish pilgrimage to Mecca in the 14th century was legendary. He’s among the earliest known examples of what could be considered millionaires.

However, the term “millionaire” itself is relatively new, coined in the late 18th century. Back then, it represented a level of wealth rarely seen. The concept of millionaires as we understand it today, tied to individual wealth generated through commerce and industry, has a more recent history. The rapid industrialization of the 19th century, innovations like the steam engine and mass production, and economic shifts during the rise of capitalism all played their part in this transformation.

In the 20th century, the rise of modern finance, stock markets, and new industries led to the creation of millionaires on a scale never before witnessed. People such as John D. Rockefeller, Andrew Carnegie, and Henry Ford became household names, synonymous with immense wealth. They amassed wealth during an era when industrialization and capitalism were transforming the financial landscape. Their fortunes also funded philanthropic endeavors that contributed to societal progress.

As we move through history, the concept of a millionaire has expanded to include various professions and new paths to wealth. Modern technology, financial markets, and entrepreneurship have transformed the landscape of wealth accumulation. Today, millionaires emerge from diverse backgrounds and endeavors, making the journey to financial success more multifaceted and, for some, more attainable.

Famous Millionaires Through the Centuries

| Time Period | Famous Millionaires |

| Ancient Times | King Croesus of Lydia |

| Mansa Musa of Mali | |

| 16th Century | Jakob Fugger (Fugger banking family) |

| 17th Century | Sir Richard Arkwright |

| Peter the Great of Russia | |

| 19th Century | John D. Rockefeller |

| Andrew Carnegie | |

| Cornelius Vanderbilt | |

| J.P. Morgan | |

| Henry Ford | |

| Early 20th Century | Howard Hughes |

| Walt Disney | |

| Thomas Edison | |

| Guglielmo Marconi | |

| Mid-20th Century | Sam Walton |

| Warren Buffett | |

| Bill Gates | |

| Steve Jobs | |

| 21st Century | Elon Musk |

| Jeff Bezos | |

| Mark Zuckerberg | |

| Warren Buffett | |

| Oprah Winfrey |

Financial Statistics

In the 21st century, global wealth distribution has become a topic of increasing importance. Various studies and statistics shed light on the distribution of wealth and the concept of becoming a millionaire. [1] [2]

One key aspect to consider is the distinction between median income and millionaire status. The median income represents the income level where half of a population earns more, and the other half earns less. This figure is often used to gauge the overall financial well-being of a population.

In contrast, millionaire status refers to an individual’s accumulated wealth, typically exceeding one million units of a given currency. While the median income provides insight into general economic conditions, achieving millionaire status generally signifies a level of financial success beyond average earnings.

Global statistics show a wide disparity in wealth distribution, with the majority of the world’s wealth concentrated in the hands of a relatively small percentage of the population. 1.2% to be precise. [3] This situation highlights the considerable challenge faced by many in their pursuit of millionaire status, despite working tirelessly to improve their financial standing. Even living in the wealthiest countries of the world does not guarantee success in this improbable quest. You have to understand these financial statistics to turn the odds in your favor.

Factors That Influence Millionaire Status

Becoming a millionaire can depend on several factors, including:

| Factors | Description |

| Education and Career | Professional success, including high-paying jobs and specialized skills. |

| Entrepreneurship | Successful entrepreneurship and smart investments in businesses or assets. |

| Inheritance and Luck | Passive wealth through family inheritance or unexpected windfalls. |

Education and Career Choices

Education often serves as a foundational step toward accumulating wealth. Career choices, such as pursuing high-demand fields or specialized professions, can significantly impact one’s earning potential. For example, careers in medicine, law, engineering, or technology tend to offer substantial incomes. Additionally, acquiring advanced degrees can lead to higher-paying positions.

Entrepreneurship and Investments

Many millionaires have achieved their status through entrepreneurship and investments. Starting a successful business or making strategic investments in stocks, real estate, or startups can generate substantial wealth. Entrepreneurs who identify market opportunities, take calculated risks, and work diligently can amass significant fortunes.

Inheritance and Luck

While self-made millionaires are common, inheritance can also lead to millionaire status. In some cases, individuals inherit wealth or assets from their families, providing them with a solid financial head start. Additionally, luck and timing can play a role in achieving millionaire status too. For example, luck can greatly influence your odds of winning a large jackpot lottery.

These factors, alone or in combination, can influence whether someone becomes a millionaire. Hard work, financial discipline, and smart decision-making often play pivotal roles in attaining this financial milestone.

Case Studies

Now let’s look at some case studies of individuals who started off not so well but eventually made it to the millionaires’ club.

Celine Dion

Celine Dion’s rise to millionaire status came through her extraordinary singing career. Her powerful voice and emotional performances captivated audiences worldwide. She earned a fortune from record sales, concert tours, and a long-running residency in Las Vegas. [4] Her achievements showcase how talent and hard work can lead to significant wealth in the entertainment industry.

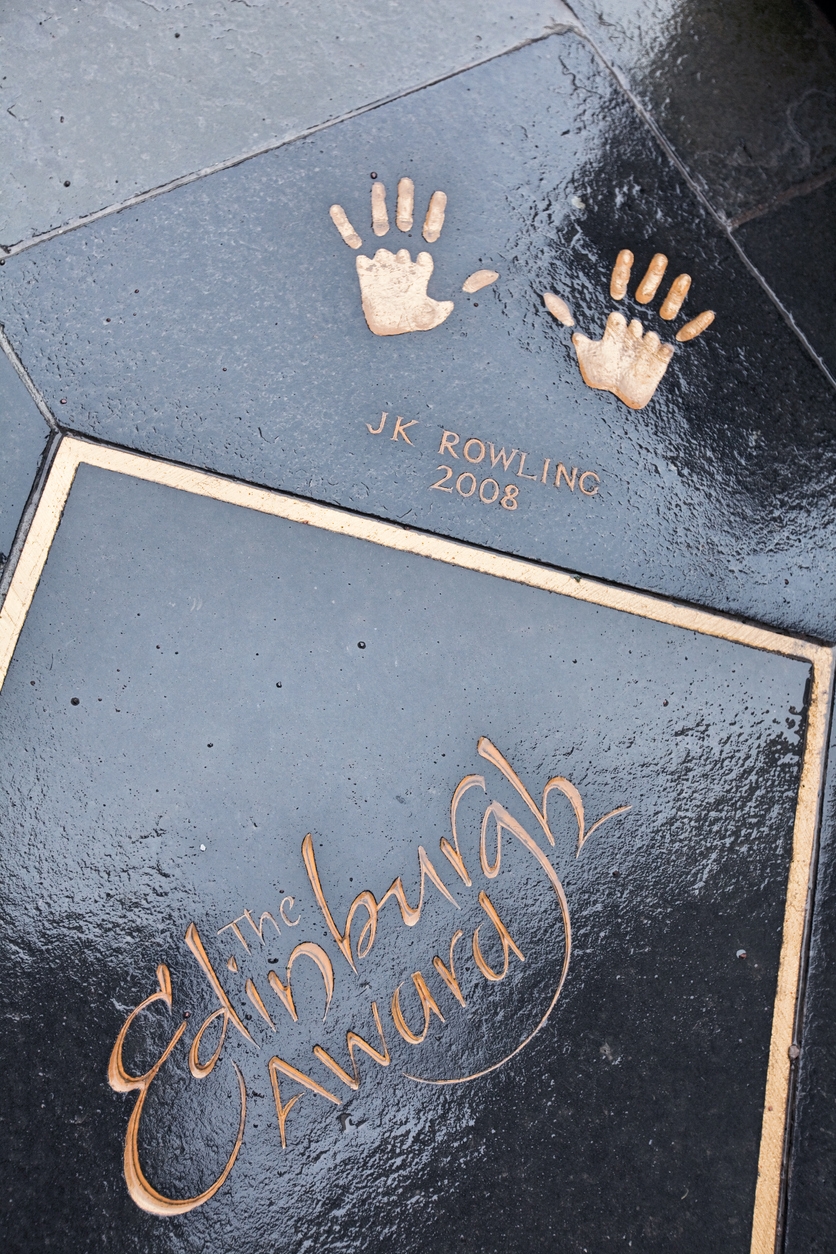

J.K. Rowling

Who doesn’t know the literary icon? However, before achieving the limelight, J.K. Rowling was a single mother struggling on welfare. The idea for the Harry Potter series came to her during a train journey, and her determination to turn it into a book series paid off. The success of her books, combined with film adaptations, merchandise, and theme parks, turned her into one of the wealthiest authors in the world. [5]

Alan Corey

Alan Corey documented his journey to becoming a millionaire by age 30 in his book, “A Million Bucks by 30.” He used various strategies, including real estate investments and frugal living, to save and invest his way to millionaire status. [6] His story serves as an example of disciplined financial planning and real estate investment.

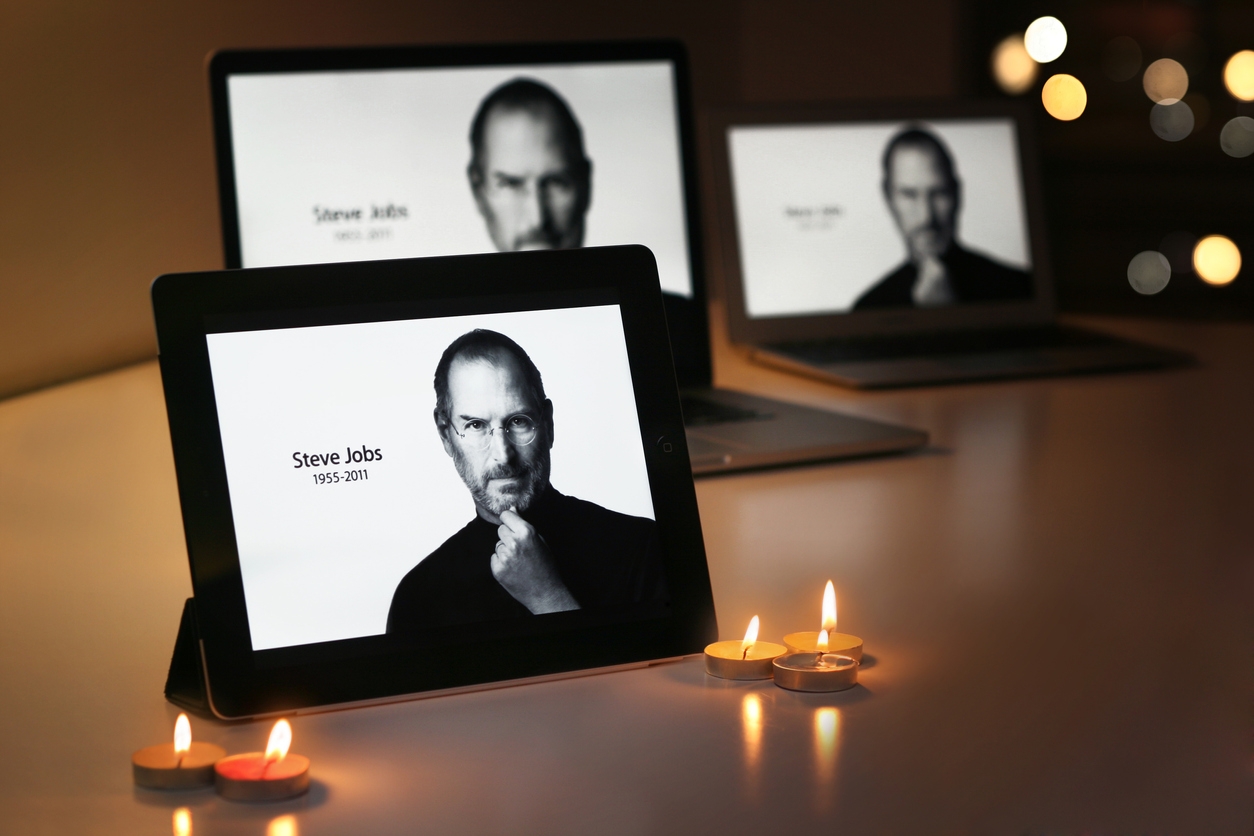

Steve Jobs

Steve Jobs co-founded Apple Inc. with Steve Wozniak in the 1970s. His vision led to the creation of groundbreaking products like the Apple I and Apple II, but it was the Macintosh and later the iPhone that catapulted Apple to new heights. His relentless pursuit of excellence and innovation revolutionized the tech industry. [7] Jobs’ return to Apple in the late 1990s saw the company’s resurgence, making it one of the world’s most valuable companies.

These individuals followed diverse paths to achieve millionaire status, from groundbreaking technology to creative writing, smart investments, and a successful entertainment career. The diverse paths they choose highlight the importance of innovation, creativity, determination, and wise financial decisions in achieving financial success.

The Role of Saving and Investing

Building wealth often begins with saving and smart investment choices. Saving involves setting aside a portion of your income for future use, which provides a financial safety net and funds for investing.

The Importance of Saving and Investment Strategies

- Financial Security: Saving provides a financial safety net, ensuring you have funds to cover emergencies, unexpected expenses, or periods of reduced income. This security allows you to avoid debt and stay on track towards wealth accumulation.

- Funds for Investment: Savings serve as the capital for investments. Whether you’re interested in stocks, real estate, or other investment vehicles, having money set aside for this purpose is crucial. It enables you to seize opportunities and build wealth over time.

Compounding Interest and Long-Term Wealth Growth

Compound interest is a powerful force in wealth accumulation. It means earning interest not only on your initial investment but also on the interest you’ve already earned. [8] Over time, compounding can significantly boost your wealth.

- Patience and Consistency

Millionaires often emphasize the value of long-term thinking. The longer your money is invested, the more it benefits from compounding. Consistently saving and reinvesting your returns is a key practice.

- Diverse Investment Options

Various investment options, such as stocks, bonds, real estate, and retirement accounts, allow you to diversify your portfolio. Diversification helps manage risk and optimize returns, contributing to long-term wealth growth.

The power of saving and investing strategies becomes evident when you realize that your money can work for you, rather than just sitting idle. While individual financial circumstances vary, these principles are fundamental to many who have achieved millionaire status.

Challenges and Obstacles

Here are the challenges and obstacles you might face on the path to becoming a millionaire:

| Obstacles and Challenges | Description |

| Debt | High-interest debt, such as student loans and credit card debt, can hinder savings and investments. |

| Insufficient Savings | Inadequate savings limit the capital available for investments and wealth accumulation. |

| Lifestyle Inflation | As income increases, some individuals increase their spending, reducing the money available for saving and investing. |

| Lack of Financial Knowledge | Limited understanding of financial concepts and investment strategies can lead to suboptimal financial decisions. |

| Market Volatility | Investments can be subject to market fluctuations, affecting their value. Economic downturns can temporarily reduce wealth. |

| Unexpected Expenses | Life events such as medical emergencies, accidents, or home repairs can strain finances, forcing individuals to dip into savings or delay investments.. |

| Job Loss or Income Reduction | Changes in employment or unexpected job losses can disrupt financial plans. |

Overcoming Challenges

Becoming a millionaire requires overcoming these challenges through diligent budgeting, debt reduction, and disciplined saving and investing. It’s important to stay committed to long-term financial goals and adapt strategies when facing obstacles. While economic downturns and financial setbacks can be disruptive, a well-diversified investment portfolio and a focus on long-term wealth growth can help mitigate their impact. Many self-made millionaires have faced and overcome these challenges on their journey to financial success.

The Psychology of Wealth

Becoming a millionaire often involves not just financial strategies but also a particular mindset and psychological traits. Many millionaires share common psychological characteristics that contribute to their financial success. Two key aspects of this psychology are financial discipline and delayed gratification.

Financial Discipline

Millionaires tend to exhibit a high degree of financial discipline. This means they have a strong ability to stick to a budget, manage their spending, and save money consistently. They often prioritize saving and investing over impulsive or unnecessary expenditures. This discipline allows them to accumulate wealth gradually, even when faced with temptations to overspend.

Delayed Gratification

Another psychological trait commonly seen in millionaires is the ability to delay gratification. This means they are willing to forgo immediate rewards or pleasures in exchange for larger, long-term gains. Delayed gratification helps millionaires stay focused on their financial goals, whether it’s saving, investing, or building a business, even when the results may not be immediately visible.

These psychological traits are essential for long-term wealth building and financial success. They enable individuals to make prudent financial decisions, withstand challenges, and stay on track to achieve millionaire status.

Conclusion

The journey to becoming a millionaire is marked by a combination of financial acumen, discipline, and a resilient mindset. Today, factors like education, entrepreneurship, investment, and inheritance play significant roles. Along the way, you may encounter obstacles and setbacks, but the ability to navigate through economic downturns and maintain financial discipline is crucial.

Historically, millionaires have come from diverse backgrounds, highlighting the various paths to wealth. The psychological traits of financial discipline and delayed gratification also distinguishes them in their financial endeavors. These characteristics, combined with smart saving and investing, provide a roadmap for those seeking to achieve millionaire status.