Blockbuster, formerly known as Blockbuster Video and formally Blockbuster LLC, was an American supplier of home movie and video game rental services. Services were initially provided mostly through video rental stores, but later options included DVD-by-mail, streaming, video on demand, and cinema theaters.

Blockbuster Entertainment, Inc. previously operated the corporation, which expanded internationally throughout the 1990s. Blockbuster had 9,094 stores and employed around 84,300 employees at its peak in 2004: 58,500 in the United States and 25,800 in other countries.

Blockbuster’s demise was mostly attributed to ineffective management, as well as increased competition from Netflix, mail-order businesses, video on demand, and Redbox automated kiosks. Significant revenue loss happened in the late 2000s, and the company filed for bankruptcy in 2010. [1]

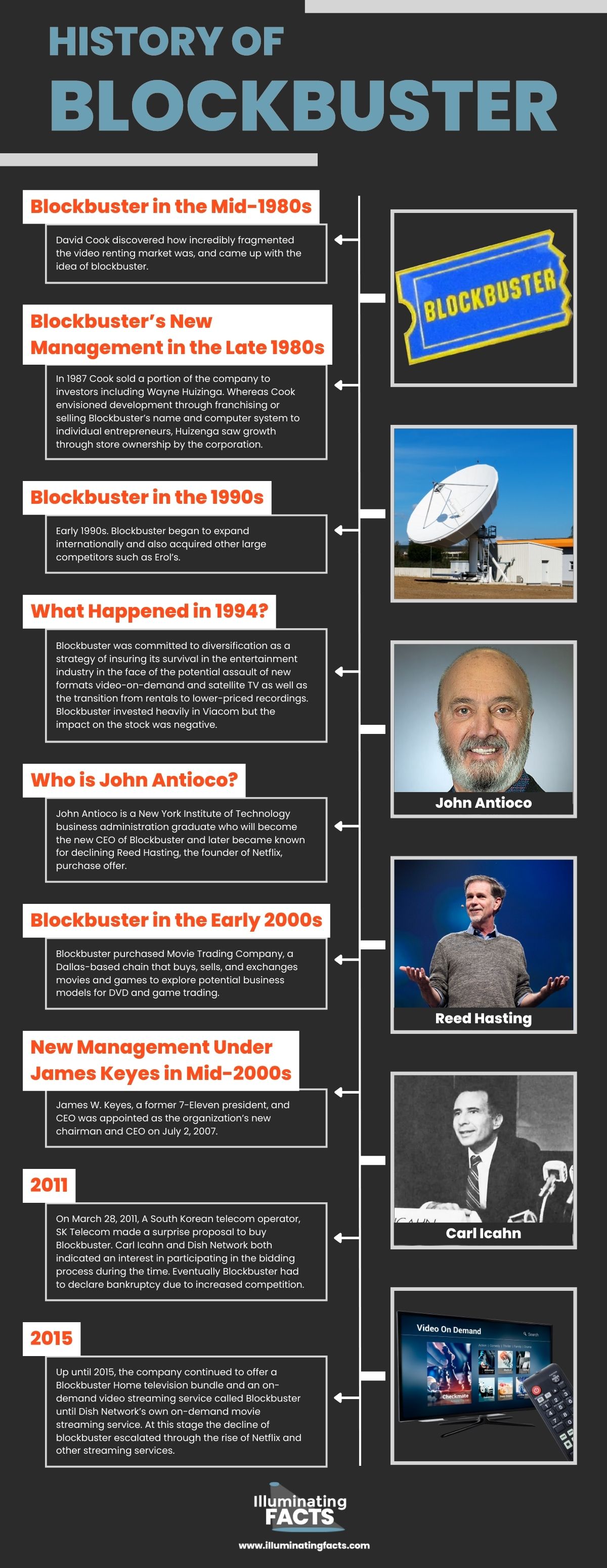

History of Blockbuster

David Cook, who had previously operated a company that offered computer software services to the Texas oil and gas industry, launched Blockbuster. After establishing the first Blockbuster in 1985, Cook realized the potential in the video rental industry and launched three more locations the following year. He sold a portion of the company in 1987 to a group of investors that included Wayne Huizenga, the creator of Waste Management, Inc., the largest waste disposal business in the world. Later that year, Huizenga took over management of Blockbuster after Cook left, and the business relocated its headquarters to Fort Lauderdale, Florida.

Under David Cook’s management, Blockbuster stores were three times larger than its competitors because, unlike other convenience stores, Blockbuster displays movie titles on the shelves rather than behind the counter. In their stores, they also utilized scanners and computer systems to look for tapes, making it easier to conduct item inspections. Cook also planned numerous crucial steps for future economic growth by choosing that blockbuster would be an uninterrupted entertainment destination so that its followers would not hesitate to watch the movie it created and to make the audience eager to see the next movie.

Blockbuster launched an aggressive expansion plan under Huizenga’s direction, acquiring other video store companies and opening many new locations. With almost 400 locations, Blockbuster was the largest video chain in America by 1988.

The media, Viacom Inc., whose trademarks include MTV and Nickelodeon, acquired Blockbuster in 1994. The digital video disc or DVD was introduced in the middle of the 1990s, and Netflix, an online DVD rental business, was established in 1997. Around that same time, the e-commerce giant Amazon.com launched a video and DVD store. The emergence of pay-per-view and on-demand movie services, which let users pay for and instantly stream movies in their homes, increased competition for Blockbuster. [2] [3]

Blockbuster separated from Viacom in 2004. To compete with Netflix, Blockbuster introduced an online DVD renting business in the same year. However, the business endeavor failed. On September 23, 2010, the company filed for Chapter 11 bankruptcy protection. The final company-owned stores shut their doors by 2014.

Blockbuster in the Mid-1980s

David Cook discovered how incredibly fragmented the video renting market was. Most outlets were small, family-run businesses that carried a limited number of previously popular films. Since distributors typically charged around $70 per tape, offering a wide range of movies required a large monetary investment.

Additionally, cassettes had to be fetched and laboriously signed out to the customer because they were typically kept behind the counter rather than being shown to deter theft. With his computing knowledge, David Cook recognized that operations could be substantially simplified by a computerized system for inventory control and check-out.

Sandy Cook, the founder’s wife, researched the movie rental sector for several months. David Cook eventually moved on from his oil and gas software company and began renting movies. Cook opened the first Blockbuster Video store in Dallas in October 1985. It had a much greater collection than its nearest competitor, with 8,000 tapes spanning 6,500 titles.

The first Blockbuster location became popular right away. The Cooks found that, contrary to what everyone had previously believed, there was considerably more demand than anyone had anticipated for renting video movies. People were curious about a wide range of other things in addition to seeing popular films that they had missed in theaters.

Cook added three more locations to the Blockbuster concept by 1986. In June 1986, Cook Data Services changed its name to Blockbuster Entertainment Corporation to better reflect the new nature of the business. The company launched an initial stock offering in September to raise capital for future growth. Unfortunately, a financial writer published a defamatory article only days before the sale was scheduled, referencing Cook’s experience in the oil sector and casting doubt on the company’s expertise in the video industry. The report caused the equity offering to be canceled, and without this infusion of cash, Blockbuster began to run out of money. The business ended 1986 with a $3.2 million deficit.

Cook eventually sold one-third of Blockbuster in February 1987 to a group of three investors who were all former associates at another firm, Waste Management, Inc. Wayne Huizenga co-founded Waste Management in 1972, which evolved to become the world’s largest garbage disposal company and served as its president and chief operating officer until 1984, when he retired. John Melk, president of Waste Management’s worldwide division, purchased the first Blockbuster franchise. The group, which included Waste Management’s senior financial officer Donald Flynn, invested $18.6 million in Blockbuster stock.

Blockbuster’s New Management in the Late 1980s

With this action, David Cook relinquished future control of Blockbuster, and Huizenga became the company’s major voice in choosing its destiny. Whereas Cook envisioned development through franchising or selling Blockbuster’s name and computer system to individual entrepreneurs, Huizenga saw growth through store ownership by the corporation.

By June 1987, Blockbuster controlled 15 locations and franchised 20 others. With this foundation, Huizenga set out to make Blockbuster the industry’s dominant player. He followed most of Cook’s policies, such as opening the store at 10 a.m. Every day from noon to midnight; a three-day rental policy that encouraged customers to rent more than one tape at a time; and a large selection of titles. Despite popular belief that the video tape rental business was primarily dependent on hits, non-hit movies accounted for 70% of Blockbuster’s rental revenues, which had the bonus of being less expensive to obtain from distributors.

Wayne Huizenga began to acquire video store chains that already controlled their local markets, seeing this as a quick way to expand. Despite these gains, Blockbuster’s plans to acquire other businesses using stock faced a loss in April 1989 when an analyst at a big stock firm produced a study criticizing the company’s fraudulent accounting practices. Blockbuster calculated its earnings by spreading the price of purchasing video store chains and creating new locations over forty years, as well as the cost of purchasing huge quantities of hit tapes over three years, much longer than tapes kept their worth. Furthermore, 28 percent of the company’s earnings came from one-time franchise fees. Despite the criticism, Blockbuster refused to adjust its accounting techniques, and the company’s stock price finally recovered to its previous level.

Blockbuster in the 1990s

Blockbuster’s growth and diversification began in the early 1990s. One solution to this issue was to explore growth in markets other than the United States. The company’s first overseas store, called the Ritz, was opened in South London by John Melk, an initial investor.

Blockbuster’s management maintained that because the video “superstore” model was susceptible to imitation, it needed to gain market share as quickly as possible to capitalize on its ground-breaking innovation. Following this idea, the firm launched its 1,000th store by the end of 1989.

Blockbuster launched a $25 million advertising campaign to boost revenue, and the company also accelerated its global expansion, expanding its facilities in the United Kingdom and planning for operations in Australia and the rest of Western Europe. By June 1990, the business had launched its 1,200th store in the United States, with new locations opening at a pace of one per day.

Blockbuster’s largest acquisition was Erol’s, a video store chain with 200 locations on the East Coast and in the Midwest, for $30 million in cash, notes, and debt assumption in November 1990.

Although Blockbuster continued to open new stores at a rapid pace in 1990, the video rental industry’s growth was decreasing. Though the company’s earnings increased by an astounding 114 percent in 1988, they fell to a still-impressive 93 percent growth rate in 1989, followed by a rate of 48 percent in 1990. In line with this tendency, 1991’s first-quarter financial results were poor.

What Happened in 1994?

Blockbuster was committed to diversification as a strategy of insuring its survival in the entertainment industry in the face of the potential assault of new formats video-on-demand and satellite TV as well as the transition from rentals to lower-priced recordings. Huizenga’s Blockbuster makeover reached a climax in September 1993, when the business proposed a $4.7 billion merger with media behemoth Viacom Inc.

Blockbuster invested substantially in Viacom, ostensibly to support Viacom’s bid to acquire Paramount Communications from rival QVC Network Inc. Viacom did win the battle for Paramount, but merger talks with Blockbuster fell through, costing Blockbuster a lot of money as Blockbuster stockholders lost faith in the firm and wondered if their investment in Viacom would pay off. Blockbuster and Viacom’s stock had plummeted by April 1994.

The glorious days of Blockbuster appeared to be done. The company was suffering from rapid changes in the industry. The video industry’s spectacular expansion began to level down as competition stiffened owing to newer emerging formats. Furthermore, there was internal conflict. The merger of Blockbuster with Viacom had been difficult, and Viacom was relying significantly on Blockbuster’s revenue to help pay its debts and have money for future investments. Furthermore, Blockbuster’s leadership appeared to be insecure. Wayne Huizenga relinquished his position as CEO of the firm in September 1994.

Who is John Antioco?

John Antioco is a New York Institute of Technology business administration graduate who will become the new CEO of Blockbuster and later became known for declining Reed Hasting, the founder of Netflix, purchase offer. Hastings was just a newcomer in the business at the time.

Blockbuster was in trouble by the time John Antioco took leadership in the summer of 1997. As a result, the company reduced its expansion plans and refocused on its main business, video rentals. It departed the computer business in late 1997, closing its PC Upgrades outlets mere months after acquiring the company. Despite its financial difficulties, the business still controlled 25% of the $16 billion home video industry.

The business signed revenue-sharing agreements with the big Hollywood studios under Antioco, making them financial partners. Instead of paying $65 for new tapes, Blockbuster now paid $4 and gave the studio 30 to 40% of the rental proceeds. In early 1999, it continued to expand overseas, purchasing a video chain in Hong Kong, Oregon, and Washington. The chain was profitable once more, and its share of the home video retail market climbed to 31%. The video market was still declining, losing 2.6 percent in 1998 and 8.4 percent in the first half of 1999.

Blockbuster appeared to be on the recovery when Viacom conducted an initial public offering of around 18 percent of its stock in Blockbuster in August 1999, to completely divest it. The sale attracted only $465 million; plainly, investors did not trust Blockbuster’s future, and the company needed to find a viable business strategy. Management attempted to increase Blockbuster’s market share in the expanding tape and disk rental segment. Moreover, it is also committed to exploring new distribution channels, such as those offered by e-commerce.

Blockbuster in the Early 2000s

Blockbuster purchased Movie Trading Company, a Dallas-based chain that buys, sells, and exchanges movies and games to explore potential business models for DVD and game trading. The business made huge profits from late fees that accumulated after the one or three-day rental period had ended. Fines accounted for $800 million or 16% of all revenue in the year 2000. A movie or game that was more than eight days late resulted in the client being charged the entire purchase price.

When Reed Hastings of Netflix met with Blockbuster in 2000 to pitch the potential of his company handling Blockbuster’s online initiatives, Netflix was just getting started as a DVD-by-mail and streaming business. Blockbuster couldn’t see how Netflix’s founder could offer any value to their immensely successful business at the time. Blockbuster turned Reed Hastings away while laughing at Netflix’s concept.

Total Access, a billion-dollar campaign by Blockbuster was launched in 2007 as a counter-strategy to Netflix. Customers may rent a DVD online and receive a new movie for free when they returned it to a Blockbuster shop via Blockbuster Online. While it was a huge success, each free movie cost the firm $2, but the assumption was that it would bring in enough new customers to make up for the loss.

In exchange, a new system would be implemented in which customers may return their DVDs to a Blockbuster location. Carl Icahn who is a board member of Blockbuster intervened and blocked the acquisition from going through, insisting that the firm not lose any more money because of Total Access. Carl Icahn is a successful American investor and corporate raider with a current net worth of $17.7 billion. He is presently 80 years old and the world’s 43rd richest person. Blockbuster was already in jeopardy before Icahn got involved. Customers were fleeing to companies like Netflix and Redbox. They were both newcomers with no physical storefronts offering the same popular movies at a lesser price at the time.

In July 2007, John Antioco was fired. As a result, Blockbuster Online’s earlier rapid expansion came to a halt. Antioco’s exit was also flawed by ongoing disagreements over his pay. When he resigned, he was compensated $24.7 million.

New Management Under James Keyes in Mid-2000s

James W. Keyes, a former 7-Eleven president, and CEO was appointed as the organization’s new chairman and CEO on July 2, 2007. He unveiled a new business strategy that includes improvements to current storefronts and a shift to streaming video to compete with Netflix.

Blockbuster issued a bankruptcy notice after experiencing prolonged revenue reductions that threatened its ability to pay its roughly $1 billion in debt. Carl Icahn had left the Blockbuster board of directors and had sold nearly all his stock by April 1, 2010.

The organization was delisted from the New York Stock Exchange on July 1, 2010, because its shareholders failed to approve a reverse stock split plan intended to prevent an involuntary delisting due to the stock’s trading at much less than $1 per share. Blockbuster was given until August 13, 2010, to settle the debt after it was unable to pay bondholders an interest payment of $42.4 million.

Blockbuster had nearly 6,500 sites at the start of 2010, with 4,000 of those being in the United States; by late October of the same year, that number had dropped to 3,425. Blockbuster planned to file a pre-packaged Chapter 11 bankruptcy in mid-September. Tom Casey, who was the organization’s chief financial officer during that time, resigned on September 11, 2010, because of Blockbuster’s plan.

Blockbuster filed for Chapter 11 bankruptcy on September 23, 2010, because of difficult losses, $900 million in debt, and fierce competition from Netflix, Redbox, and on-demand video services.

2011

On March 28, 2011, A South Korean telecom operator, SK Telecom made a surprise proposal to buy Blockbuster. Carl Icahn and Dish Network both indicated an interest in participating in the bidding process during the time. In addition, DISH Network Corporation is an American television provider and the owner of Dish Network, a direct-broadcast satellite service.

On April 6, 2011, Dish Network claimed victory in the auction and consented to purchase Blockbuster for $320 million while taking on $87 million in liabilities and other commitments. Dish Network announced on April 19, 2011, that only 500 Blockbuster locations will remain open. Dish’s acquisition of Blockbuster was done on April 26, 2011.

Blockbuster and Dish Network made plans to introduce Blockbuster Movie Pass, a new service that would compete with Netflix later in September. Subscribers would have access to a streaming service of movies and games by mail for $10 per month. The bundle which was solely accessible to Dish Network eventually went out of business.

To avoid bankruptcy, the business stated in December that it will close an additional 182 stores by the end of April 2011. In February 2011, it was reported that Blockbuster and its creditors had failed to develop a Chapter 11 exit strategy and that the company will be sold for $300 million or more, with debts and leases also being assumed. Blockbuster acknowledged that it might not be able to fulfill its financial commitments under its Chapter 11 file, which might require conversion of the bankruptcy filing to Chapter 7. The most common type of bankruptcy is a liquidation bankruptcy, often known as Chapter 7. It is notable for offering a firm or business a second chance to reclaim control of their finances by having most of their unsecured debt formally charged by a bankruptcy court. However, the Department of Justice revealed in a claim that Blockbuster lacked the resources to continue its reorganization and should be liquidated.

2015

Up until 2015, the company continued to offer a Blockbuster Home television bundle and an on-demand video streaming service called Blockbuster until Dish Network’s own on-demand movie streaming service, the DISH Movie Pack, took its place. According to other executives in the sector, the company’s ongoing downfall was caused by bad leadership. [2] [3] [4]

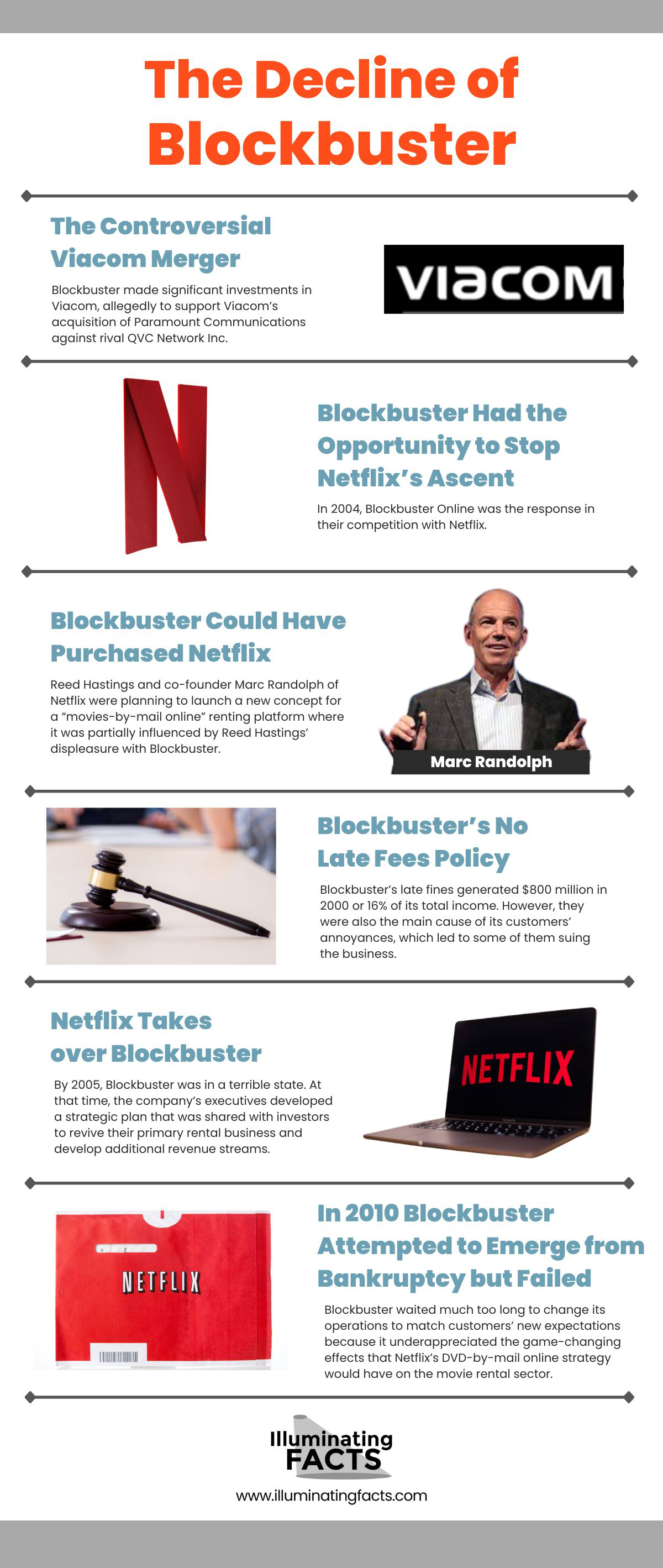

The Decline of Blockbuster

The Controversial Viacom Merger

Blockbuster made significant investments in Viacom, allegedly to support Viacom’s acquisition of Paramount Communications against rival QVC Network Inc. QVC is a free-to-air television network and flagship shopping channel in the United States that specializes in televised home shopping. QVC Network Inc. is in West Chester, Pennsylvania.

Viacom did rout Paramount in the fight, but Blockbuster suffered greatly because of the deadlock in the merger talks. Blockbuster stockholders lost faith in the company and began to doubt if their investment in Viacom would be profitable. Blockbuster and Viacom’s stock had fallen rashly by April 1994.

The heyday of Blockbuster seemed to be over. Insiders determined that the business was struggling because of significant changes in the sector. The video industry’s explosive expansion started to slow because of stiffer competition brought on by recently developed formats. Additionally, there was a problem on the inside. Though it was eventually completed, the merger between Blockbuster and Viacom had been difficult, and it was said that Viacom was largely reliant on Blockbuster’s finances to help it pay off debt and have money for future projects.

In addition, Blockbuster’s management appeared inconsistent. In September 1994, Wayne Huizenga gave up his position as president of the company and Steven Berrard took over. Berrard was President of Huizenga Holdings, Inc. and held several positions with Huizenga Holdings companies, including Waco Leasing Company and Port-O-Let International, Inc., where he was President, Chief Financial Officer, Treasurer, and Secretary. Mr. Berrard had worked with Coopers & Lybrand before joining Huizenga Holdings.

During his first year and a half in the position, Berrard concentrated on swiftly growing the business. However, Berrard resigned amid legal opportunities arising from prior business deals, and Bill Fields took over in March 1996. Soon after, Fields was appointed CEO as well. He tried to restore the company’s reputation during his brief time in that position.

Blockbuster Had the Opportunity to Stop Netflix’s Ascent

In 2004, Blockbuster Online was the response in their competition with Netflix. By 2005, the service had one million customers and was rapidly growing even though Blockbuster Online trailed Netflix in terms of online subscriptions. Netflix nearly went out of business after Blockbuster’s next move, the Blockbuster Total Access, a service that let you rent DVDs and have them delivered to you just like with Netflix.

With Total Access, you could exchange your returned films for other movies at a Blockbuster shop rather than having to wait for delivery, which was a bonus over Netflix. It was an attempt to attract Netflix users away with fast satisfaction. By 2006, Blockbuster was once again prospering.

Blockbuster Could Have Purchased Netflix

Reed Hastings and co-founder Marc Randolph of Netflix were planning to launch a new concept for a “movies-by-mail online” renting platform where it was partially influenced by Reed Hastings’ displeasure with Blockbuster. But the strategy wasn’t financially viable until lightweight DVDs took the place of bulky VHS tapes.

Although Netflix had about 193 million customers as of July 2020, it was having trouble when it first started. Reed Hastings and Marc Randolph went to Blockbuster, their biggest rival at the time, and made an offer to buy Netflix for $50 million.

Later, Randolph said that when they announced the price, Blockbuster CEO John Antioco mocked them. Despite this, throughout the early 2000s, Netflix repeatedly came back with offers. Instead, Blockbuster agreed to launch an on-demand video service in 2000.

Blockbuster’s No Late Fees Policy

Blockbuster’s late fines generated $800 million in 2000 or 16% of its total income. However, they were also the main cause of its customers’ annoyances, which led to some of them suing the business.

Blockbuster settled a lawsuit in 2001 regarding a policy company had implemented. They would only charge the cost of the initial rental, regardless of how late the tape was returned, as opposed to charging the cost of the initial rental for each day beyond the return date. Even though this was good for customers, Blockbuster hadn’t made the new policy clear enough.

Blockbuster had just rebranded the late fees under the false name “No Late Fees policy,” rather than genuinely getting rid of the said policy the day following the return date, Blockbuster automatically charged the cost of the movie or game. If one ultimately decided to return the item, you would receive a refund less a $1.25 restocking fee. Blockbuster paid $630,000 to settle with 47 states and the District of Columbia after being sued.

Netflix Takes over Blockbuster

By 2005, Blockbuster was in a terrible state. At that time, the company’s executives developed a strategic plan that was shared with investors to revive their primary rental business and develop additional revenue streams. They attempted to achieve this by providing in-person and online subscriptions, movie exchanging, eliminating late fees, and introducing their line of video games under the Blockbuster name. The outlook in the report was good. Netflix, though, had already gone public in 2002.

Netflix had already surpassed Blockbuster by the time it attempted a comeback with mail-in and online DVD rentals. In the end, Blockbuster’s plan to install rental kiosks in malls was unsuccessful. Even Total Access was short-lived. Blockbuster was eclipsed by Netflix and other businesses that now made it possible to view anything you wanted with a click as streaming gained popularity at the same rate that internet connections did. Blockbuster simply couldn’t enter the streaming game.

In the end, Netflix far outperformed Blockbuster. Blockbuster was attempting to catch up while Netflix was embracing whatever was popular at the time, and Netflix continued to develop as it embraced emerging technology. When Netflix discovered that certain cable providers offered video on demand and movie downloads, it seized the opportunity and began to create its streaming service.

Blockbuster was finally forced to declare bankruptcy in 2010. Tens of thousands of employees faced mass dismissals, and the future looked miserable. One factor in Netflix’s success was its algorithm, which generated recommendations based on films you had already seen. Later, businesses like Hulu and Amazon would employ the same technology to pique the interest of customers.

Blockbuster Attempted to Emerge from Bankruptcy but Failed

Blockbuster waited much too long to change its operations to match customers’ new expectations because it underappreciated the game-changing effects that Netflix’s DVD-by-mail online strategy would have on the movie rental sector.

Netflix was established in 1998, and in 2003 it reported its first profit of $6.5 million. In 2004, Blockbuster launched Total Access, a competing online DVD-by-mail renting service. By December of that year, Netflix had 6.3 million subscribers, exceeding its two million objectives for the year. The next year, Total Access was discontinued because of how expensive it was for Blockbuster to continue its operations.

In the same period, Netflix launched its streaming program. Following Redbox’s lead with its on-demand platform in 2008. Redbox had pioneered this idea six years earlier however, due in part to Viacom’s departure, Blockbuster was roughly $1 billion in debt in March 2010 and was fighting for its life. Keyes continued in denying the allegation. \

The business filed for Chapter 11 in September 2010, which allowed it to continue operating while attempting to restructure its debt. For a while, Blockbuster had a second chance. Dish Network, a satellite TV provider at a bankruptcy auction, purchased it for $228 million in cash. The idea was to combine Dish’s offerings with Blockbuster’s on-demand streaming platform. However, Dish Network announced in 2013 that it was closing every Blockbuster location as well as the DVD-by-mail service. [4] [5]

Blockbuster Today

There is only one extant Blockbuster location, and it can be found in Bend, central Oregon, about three hours from Portland. It wasn’t nearly so lonely until August 2018 since the final two Blockbusters in Alaska closed that month, only a few months after Huizenga passed away from cancer.

Thanks to devoted customers and tourists, Blockbuster has survived. General manager Sandi Harding told Vice that during the covid-19 pandemic, they were obliged to temporarily close out of concern for people’s safety, but they continued to pay staff and implemented social distancing measures that have allowed them to reopen at a scaled-down capacity.

They have also resorted to more innovative strategies to maintain public interest and awareness. On their website, you can purchase locally produced Blockbuster swag like keychains, sweatpants, and sweatshirts. [5]

Blockbuster CEO and Executives [6]

- David Cook

- Wayne Huizenga

- Dennis McGill

- John Polizzi

- Rebeca Johnson

References:

[1] Working at Blockbuster LLC, Blockbuster LLC Overview from

https://www.zippia.com/blockbuster-llc-careers-1327661/

[2] Blockbuster Inc., Company Histories from

https://www.company-histories.com/Blockbuster-Inc-Company-History.html

[3] The Day in History, First Blockbuster store opens

https://www.history.com/this-day-in-history/first-blockbuster-store-opens

[4] Blockbuster LLC Company History Timeline, Blockbuster LLC History from

https://www.zippia.com/blockbuster-llc-careers-1327661/history/

[5] The Untold Truth of Blockbuster from

https://www.grunge.com/250288/the-untold-truth-of-blockbuster/

[6] Blockbuster LLC Leadership, Blockbuster LLC Executive from

https://www.zippia.com/blockbuster-llc-careers-1327661/executives/